ev tax credit bill text

If you purchased a Nissan Leaf and your tax bill was 5000 that. On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals.

A Complete Guide To Home Filing Cabinets Categories And More Home File Organization Organizing Paperwork Filing System Home Organization Binders

EV tax credit bill from Senate Finance Committee.

. Current EV tax credits top out at 7500. A BILL ENTITLED 1 AN ACT concerning 2 Clean Cars Act of 2022 3 FOR the purpose of extending and altering for certain fiscal years the vehicle excise tax 4 credit for the purchase of certain electric vehicles. State and municipal tax breaks may also be available.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the. While the bill is not expected to gain any Republican support. For example the possibility of Tesla and GM once again becoming eligible for the tax credit could be big news for consumers.

Heres how you would qualify for the maximum credit. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

However only specific types of electric vehicles qualify for. The amount of the credit will vary depending on the capacity of the battery used to power the car. There has even reportedly been talk of changing the EV tax incentive into a refundable credit.

Meanwhile Republicans on the senate managed to draft a bill that kept both in place. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year. Build Back Better Act.

The credit amount will vary based on the capacity of the battery used to power the. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Federal Tax Credit Up To 7500.

12500 EV tax credit still alive but not yet approved House Speaker Nancy Pelosi began Fridays congressional session with plans to vote on. But the Build Back Better plan includes an additional 4500 tax credit for consumers who purchase a union-built American-made electric vehicle. The GeekWire Awards return May 12 2022.

There is no tax credit if you decide to lease a. Washington state lawmakers go big on EV battery charging scale back near-term rebates. Elon Musk has accused Microsoft co-founder Bill Gates of shorting Tesla.

The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. The US Senate has voted to approve a non-binding resolution setting a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit.

The frameworks electric vehicle tax credit will lower the cost of an electric vehicle that is made in America with American materials and. The tax credit would last for five years once the Build Back Better plan is passed by the US. Congress is poised to fix the most annoying thing about buying an electric car The new EV tax credit would be 12500 and refundable.

If this works out it could be a huge boon to the auto industry. The EV tax credit has traditionally only applied to new cars but this bill provides up to 2500 credit for used EVs with at least a 10 kWh battery although the credit cannot exceed 30 of the sale price. B Limitation.

The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if. If you were counting on generous rebates from Washington state to. Text for HR5376 - 117th Congress 2021-2022.

Senate Finance Committee Approves 12500 EV Tax Credit Bill. And the buyers adjusted gross income AGI has a cap at 75000 for individuals 112500 for head of household and 150000 for joint filers. House of Representatives and the US Senate and signed by Biden.

The latest proposal involves up to a 12500 EV tax credit an increase from the current 7500 EV credit but with a number of potential changes. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The bill also offered record incentives for used electric cars and it would have removed a provision that renders automakers ineligible for existing credits after selling 200000 EVs.

Decreasing for purposes of the 5 electric vehicle excise tax credit the limitation on the maximum total purchase price. Changes include raising the federal EV tax rebate ceiling to 12500 and opening the door for automakers who already exhausted their production quotas. It would limit the EV credit to.

The EV tax credit proposed by Biden and other Democrats would be an increase from the current 7500 credit to a maximum of 12500. 7500 EV tax credit reinstated 2500 for made 2500 for union made. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers.

In a tweet on Friday the Tesla CEO admitted that he asked Gates if he was short-selling shares of the electric carmaker. The way this works is that in the initial draft of the 15 trillion House tax bill the 7500 electric-vehicle tax credit and the wind production tax credit would both be eliminated.

Tesla And Spacex Faces Severe Inflationary Pressure In Raw Materials And Logistics According To Elone Musk Enjoy Complete Brokerage Services Only At Atompix A In 2022

Solar And Wind Thrive Despite Cheaper Oil And Gas Energy Saving Facts Ambit Energy Oil And Gas

Photon Rainbow Solar Energy Blog For New Mexico Photon Rainbow Solar Energy Solar Energy Companies Solar Energy Solar

Pta Event Planning Template Google Search 5th Grade Events 5th Event Ev Event Planning Worksheet Event Planning Template Event Planning

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Image Result For Ev Market In India Infographics Energy Companies Energy Infographic

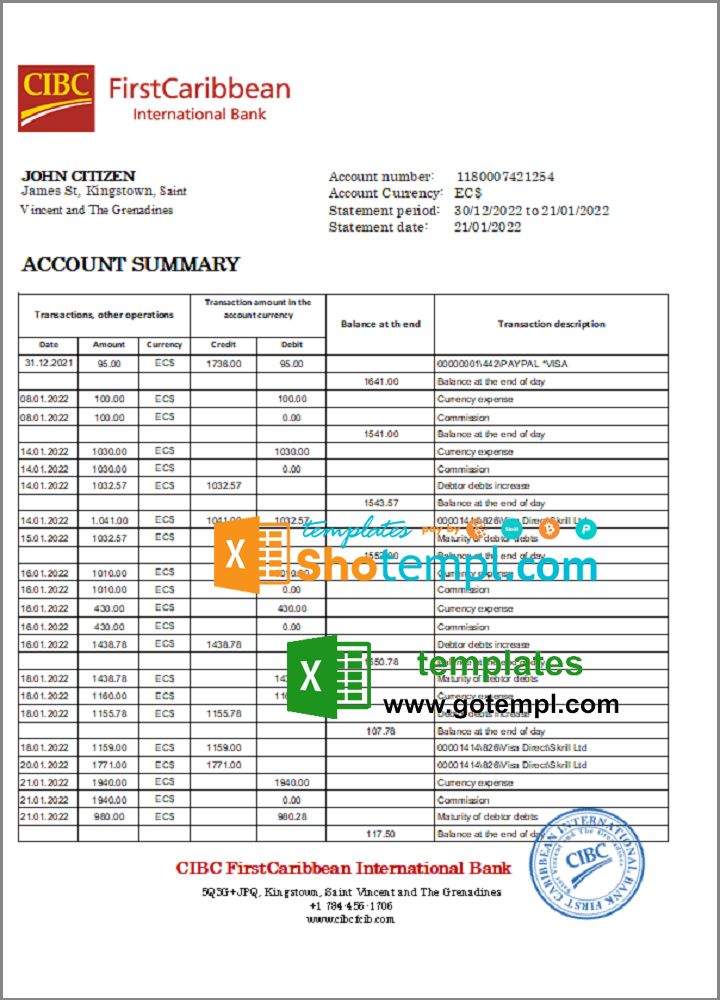

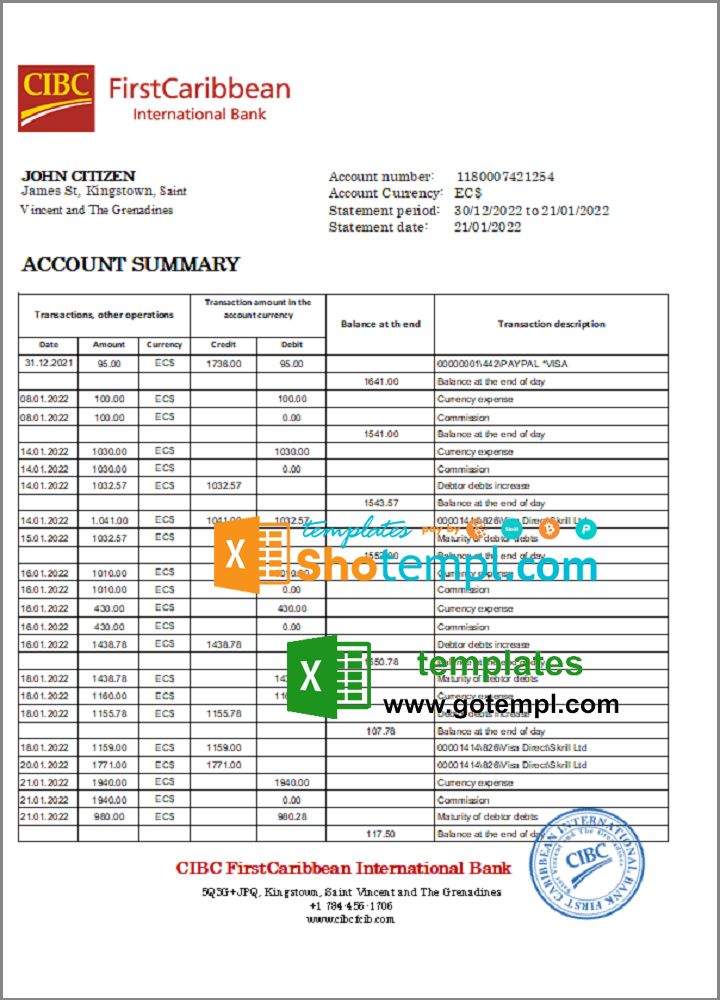

Saint Vincent And The Grenadines First Caribbean International Bank Statement Template In Excel And Pdf Format Gotempl Templates With Design Service In 2022 Statement Template International Bank Templates

Http Energybillsbefree Com Home Solar Rebate Energy Bill Solar Energy Companies Solar Savings

Cost Comparison Solar Shingles Vs Solar Panels Solar Panels Solar Energy Solar

Energy Storage Axium Solar Commercial Residential Solar Energy Storage Solar Companies Residential Solar

2018 Guide To Washington D C Home Solar Incentives Rebates And Tax Credits Save Energy Incentive Solar Energy Panels

New Super Battery Energy Storage Breakthrough Aims At 54 Per Kwh Energy Storage Energy Company Storage

4 Ways Solar Panels Help Lower Monthly Bills In 2022 Solar Panel Companies Solar Panel System Solar Panels

For Figuring Out How Long To Keep That One Medical Bill Paper Clutter Organization Organizing Paperwork Clutter Organization

Tesla S Latest Financial Statement Shows Bitcoin Worth 1 26 Billion Finance Bitcoin News In 2022 Cash Flow Statement Financial Statement Bitcoin

Compromise Version Of Tax Bill Reportedly Spares Ev Credits Bills Credits Compromise

Electric Vehicle Ev Rebates Electricity Electric Cars Electric Vehicle Charging Station